We are now more than seven months into 2024, and events have generally transpired in line with Greymantle’s January 2024 forecast, with one very big exception, namely the ease with which Donald Trump won the Republican nominating contest for U.S. President, along with steady improvement in Trump’s polling numbers and fundraising between the start of the year and late July.

A smaller exception, but a minor earthquake nonetheless, was the withdrawal of President Joe Biden from the presidential contest on Sunday, July 21. Greymantle had forecast a 25% likelihood of Biden bowing out of the race by mid-summer back in January, so Biden’s decision did not come as a complete surprise to us. The relative lateness of the decision, however, in mid-July rather than early May, was a shock as we had expected Biden to time his exit more fortuitously for his successor.

We’ll dig deeper into the Trump exception shortly.

First, we’re going to run through a quick survey of the world economy, financial markets, and year-to-date election results to see where our forecasts were more or less on target, and where events followed different paths than we had anticipated in our 2024 Mid-Year Review: Expect More Turbulence Ahead After Early Summer Shocks.

WORLD ECONOMY: RESILIENT OVERALL, BUT WITH PERSISTENT WEAK SPOTS

As we pass the midpoint of 2024, the global economy presents a mixed picture of resilience and challenges. Here’s a detailed look at the performance of major economies:

United States: The U.S. economy demonstrated robust growth in the first half of 2024 – solidly in line with Greymantle’s January forecast – driven by strong consumer spending and a resilient labor market. The GDP growth rate at 2.1% for 1H24 is solid, though slightly below last year’s highs. Inflation continues to gradually moderate, but remains just above the Federal Reserve’s official target, prompting a delay in short-term rate hikes. We expect the first such hike to occur in September. The technology sector is thriving, buoyed by advancements in AI and green technologies. However, the housing market shows signs of cooling, reflecting higher mortgage rates and affordability concerns.

European Union: The EU economy experienced uneven growth through June, with major economies like Germany and France showing moderate expansion. Inflation remains a a challenge but has backed off from 2023 levels. This led the European Central Bank to shift to a looser monetary policy stance and reduce its short-term rate to 3.75% on June 6 from 4% previously. Energy prices have stabilized somewhat, but concerns over potential future supply disruptions remain salient due to ongoing geopolitical tensions. Southern Europe are benefiting from a strong tourism season; industrial output in Northern Europe still faces some headwinds from global supply chain disruptions.

Russia: Russia’s economy continues to grapple with the impact of Western sanctions and the ongoing conflict in Ukraine. Despite these challenges, high energy prices have provided support to the Russian economy given Russia’s status as a major petroleum exporter.

The value of the Russian ruble remains volatile, and consumer prices are high, straining household budgets. The government’s fiscal policies have focused – so far with success – on mitigating the impact of sanctions and supporting key sectors like agriculture, aerospace and manufacturing. Steady exports of Russian weaponry to traditional customers like India and growing numbers of Arab and African nations provide Russia a key source of revenue.

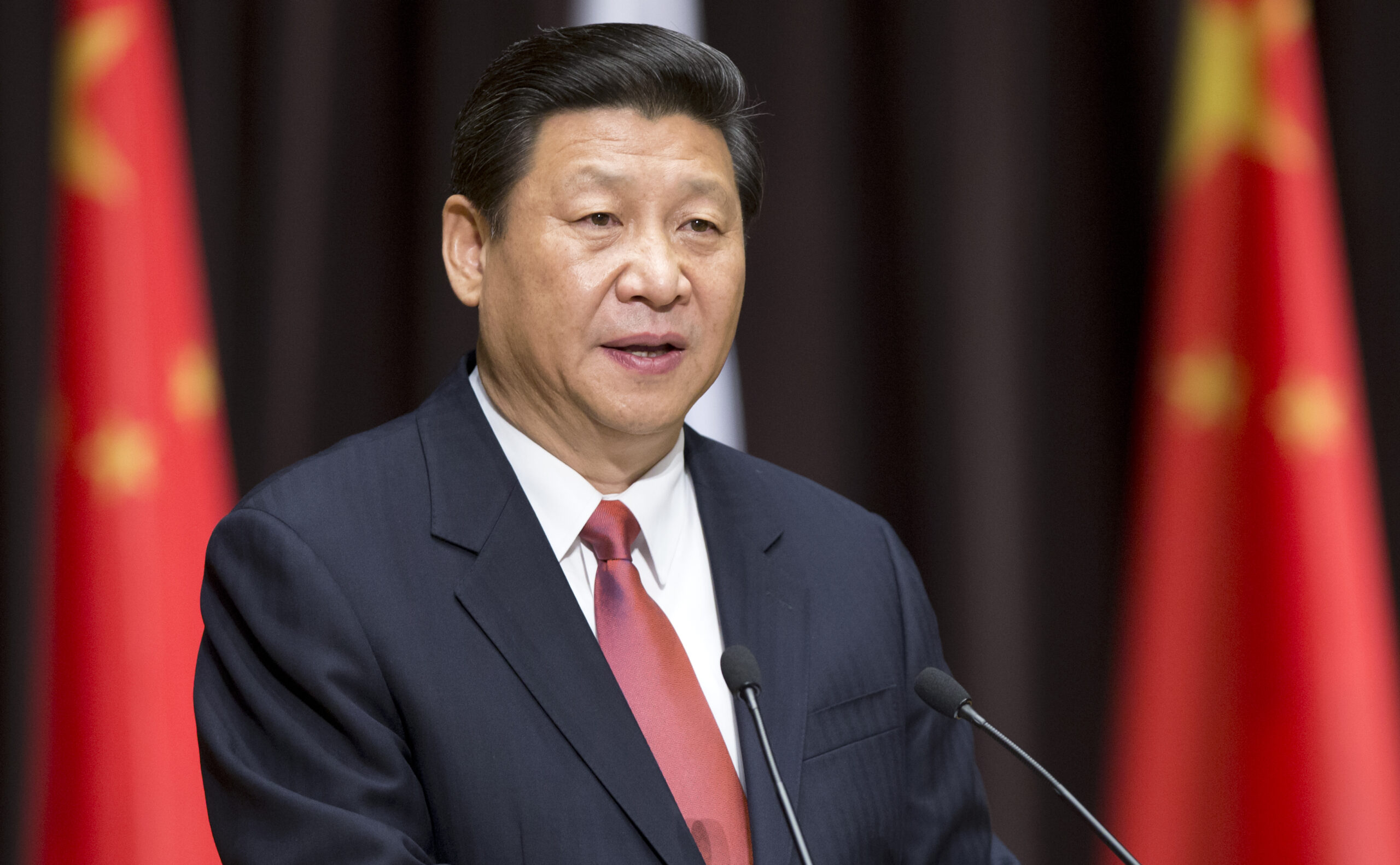

China: China’s economic performance in 2024 has been weaker than expected, with GDP growth slowing due to a combination of domestic and international factors. The real estate sector remains under massive stress akin to what the U.S. and EU experienced during the 2007-2009 period, and regulatory crackdowns on various industries have created an uncertain business environment. Nevertheless, the government is implementing stimulus measures aimed at boosting domestic consumption. Export growth has slowed, impacted by weaker global demand and trade tensions.

These developments are in line with Greymantle’s January 2024 forecast, as we took a bearish view toward the Chinese economy. The economic consensus was for slightly stronger growth.

South America: Conditions in South America are diverse, reflecting varying challenges faced by countries across the region. Brazil’s economy registered moderate growth, supported by steady agricultural exports and increased investment in renewable energy. But inflation remains a concern, and political instability in nations such as Ecuador and Venezuela is negatively impacting investor confidence. Argentina continues to struggle with high inflation and debt, despite efforts to stabilize the economy through IMF-backed reforms. Other countries in the region, like Chile and Peru, are experiencing steady growth driven by mining exports and fiscal prudence, although this growth does not eliminate Peru’s risk of a return to political instability over the two-year horizon.

GLOBAL EQUITIES REGISTER MIXED PERFORMANCE

As of mid-2024, global equity markets show a mixed performance. The U.S. stock market, represented by the S&P 500, saw gains through 1H 2024, though the pace has moderated compared to 2023.

The market’s pre-August rally was supported by strong corporate earnings, particularly from major technology companies, and a favorable economy. Retail fund flows have increased as investors move out of safer assets into equities. However, high valuations, particularly in the technology sector, and concerns over inflation and future Fed policies have introduced some volatility.

The U.S. market’s steep drop between August 3 and 6, during which time the S&P 500 dropped by 2%, was balanced by a rebound in the second half of last week as equities retraced most of their losses. The fall in the index was the largest in two years, and while paling in comparison to the Nikkei index’s more than 12% decline in the same time frame – a true market crash – the sudden and unexpected rise in volatility has nevertheless put investors in U.S. equities deeply on edge.

European equities have shown healthy growth in 2024, albeit at a slower rate compared to the U.S. The UK and major EU economies like Germany and France have benefited from improved corporate profits and a relatively stable economic environment. However, solid performance has been tempered by ongoing challenges, including high inflation and the impact of ECB monetary tightening. The positive outlook in industrials and cyclicals has been somewhat offset by weakness in other areas.

CHINA THE LAGGARD; INDIA THE RESILIENT

Chinese equity markets have faced significant headwinds in 2024. As mentioned above, Chinese economic growth has been slower than anticipated, with concerns over real estate sector stability and regulatory pressures continuing to weigh heavily on investors. Despite low equity valuations offering potentially strong opportunities, market performance has lagged behind other major economies.

India’s stock market, by contrast, has shown resilience, supported by strong economic fundamentals and robust corporate earnings growth. High consumer demand and government initiatives have also bolstered market confidence. High valuations in certain sectors such as technology, however, have led to cautious investor sentiment. Despite high stock prices, India remains an attractive market for long-term ‘value’ investors due to its growth potential.

Equity markets in South America, particularly in countries like Brazil, have had a mixed performance. Political instability and economic challenges, including inflation and currency fluctuations, have created a volatile investment environment. However, commodity-driven economies have benefited from strong global demand for resources, providing some support to their equity markets.

While 2023 was characterized by strong gains across most major markets driven by post-pandemic recovery and accommodative monetary policies, 2024 has seen a more cautious approach with higher volatility and sector-specific performance variations. The end of aggressive rate hikes and a shift toward more normal monetary policies have played a significant role in moderating growth expectations.

In summary, while equity markets generally performed to July 2024, the extent and sustainability of this performance is likely to vary widely across regions and sectors.

ELECTIONS SHOOK OUT BROADLY AS EXPECTED, WITH THREE NOTABLE SURPRISES

Russia: The Russian presidential election saw President Vladimir Putin secure another six-year term, amidst claims of electoral irregularities and opposition protests. The election results further solidify Putin’s grip on power, despite international criticism. Putin’s victory comes as no surprise to Greymantle who predicted it in this January 2024 blog post (few international observers were surprised either!).

The big question following the election was whether Putin would call for a general military mobilization of Russia similar to Nicolas II at the start of World War I. He did not do so. Greymantle foresaw that Putin would avoid this maximalist course of action several months ago, but it was very much an open question among Europeans, causing great anxiety for Ukrainians and Russia’s near neighbors.

India: India’s general elections resulted in a victory for the incumbent Bharatiya Janata Party (BJP), led by Prime Minister Narendra Modi. The BJP’s focus on economic reforms and national security continued to resonate with voters, resulting in an overall BJP victory, but with a narrowed parliamentary margin. The surprise for observers was the narrowness of the victory achieved by the BJP, which won 240 seats in India’s parliament, which contains 543 seats.

The BJP-aligned National Democratic Alliance (NDA) won 294 seats in all, allowing the BJP to form a government through a power-sharing agreement with smaller parties broadly aligned with BJP. This result surprised many seasoned observers, but not Greymantle (we did not make a prediction!). The 2024 BJP result is down from 303 seats in the 2019 election, in which the NDA won 353 seats and an outright parliamentary majority. Greymantle will be devoting more time to India-watching in future.

United Kingdom: The UK experienced a major political shift with the Labour Party winning the July 4 general election, marking a significant change from the previous Conservative government. This victory sets the stage for potential policy shifts, particularly in areas like healthcare, education, social welfare and the overall path of public spending. The election outcome was a surprise to no one, and certainly not to Greymantle, who predicted a landslide victory for Labour in our January 2024 forecast.

South Africa: In South Africa, the African National Congress (ANC) retained power in the national elections, but also with a reduced majority, similar to the BJP-led alliance in India. Economic issues, including unemployment and corruption, dominated the election discourse.

Mexico: Mexico’s presidential election saw a victory for the MORENA-led coalition, with Claudia Sheinbaum elected as the new president in an historic landslide, gaining 58% of the popular vote. Sheinbaum also made history by being elected Mexico’s first female head of state, and the first of the Jewish faith. Her administration will aim to continue the policies of the current president and her political mentor, Andres Manuel Lopez Obrador (AMLO) by focusing heavily on social program spending, boosting wages, and initiating economic reforms.

Taiwan: Taiwan’s presidential election resulted in a victory for the incumbent Democratic Progressive Party (DPP), emphasizing the island’s stance on maintaining its independence amidst increasing pressure from China.

EUROPE SHIFTS RIGHTWARD, EXACTLY AS WE PREDICTED

The June 2024 European Union parliamentary elections saw significant shifts in the political landscape, reflecting a rightward move across the bloc. As Greymantle had rightly predicted in January, a motley coalition of far-right parties that included Giorgia Meloni’s Brothers of Italy and France’s National Rassemblment were the biggest winners and have shifted the EU’s political centre of gravity rightward overall. The center-right European People’s Party (EPP) remains the largest bloc, and centrist parties remain large, but increased political fragmentation will pose a challenge to cohesive policymaking.

Center-Right and Center-Left Performance: The center-right EPP remains the largest group in the European Parliament, with 185 seats out of 720 seats in total, but with reduced influence. They can still – and are likely to – form a coalition with the Progressive Alliance of Socialists and Democrats (S&D) and Renew Europe (RE), maintaining a centrist, pro-EU majority. However, internal disagreements on key issues like climate policy, migration, and social policy will challenge their ability to steer the political direction of the EU as effectively as during the last term.

Far-right parties made notable gains. In France, Marine Le Pen’s National Rally secured nearly a third of the votes, becoming the leading far-right force in the EU Parliament. Similarly, the Brothers of Italy, led by Italian Prime Minister Giorgia Meloni, garnered significant support, with over a quarter of Italian votes. The Identity and Democracy (ID) group and the European Conservatives and Reformists (ECR) will collectively hold 131 seats, reflecting the broader rise of far-right influence across the EU.

Impact on Major EU Countries: The far-right’s success had immediate national repercussions. In France, President Emmanuel Macron called for snap national elections in response to the National Rally’s victory, which the French far-left coalition won on July 7 due to centrist candidates withdrawing from the election at the last minute and endorsing far-left candidates to prevent a victory by the far-right NR. That results was certainly an ‘early summer shock’ as the far-right had been favored to win. In Germany, the poor performance of the ruling coalition in local elections weakened Chancellor Olaf Scholz, with the conservatives and far-right parties gaining ground.

Other Political Groups: The Greens experienced a significant setback, losing 18 EU seats, primarily in France and Germany. Despite minor gains in some countries like the Netherlands and Denmark, their overall influence in the European Parliament has notably diminished. Renew Europe also saw 23 seat decline, particularly in France and Spain, reducing its role as a kingmaker within the Parliament.

Overall, 2024 elections have set the stage for a more fragmented and polarized European Parliament, with far-right parties poised to exert considerable influence on policy, particularly on issues like migration and national sovereignty. The pro-EU majority will need to navigate these complexities to maintain cohesion and advance its agenda.

TRUMP THE SURVIVOR EMERGED, AGAIN, UNDAUNTED IN 1H 2024

And now, to the biggest surprise (for Greymantle, at least!) of the 2024 year-to-date: the astonishing resilience of Donald Trump’s candidacy for U.S. president.

Back in January, we had given Trump GOP primary opponent Nikki Haley a slightly greater than 50% chance of besting Donald Trump in the Republican primaries. If fellow GOP candidates Ron DeSantis, Chris Christie and Vivek Ramaswamy bowed out of the contest by early February, we argued, then Haley stood slightly better than even odds of beating Trump.

In this forecast, Greymantle was proven wrong. Trump beat Nikki Haley solidly in all GOP primaries with the exception of New Hampshire, which was somewhat closer, even besting Haley in her home state of South Carolina, where she once served as governor. Ultimately, Mr. Trump was able to sow up the GOP primary contest by mid-March, solidifying his position as presumptive presidential nominee.

In our own defense, we will remind readers that Greymantle gave Haley only slightly better than 1-to-1 odds of beating Trump. In reality, her chances were probably below 25%, but looked much healthier at the start of January, before the primary voting began.

Between mid-March and mid-June, Trump’s polling numbers were consistently above those of President Biden, with Trump polling between 47% and 53% compared to Biden’s polling averages in the 42% to 46% percentage point range – a 5% gap. And then, that awful June 27 live debate performance by Biden effectively torpedoed the sitting president’s campaign for re-election.

By the second week of July, less than two weeks before he bowed out of the race, Biden’s chances of being re-elected had dropped to below 25% and may have actually been in the range of 15%. Trump’s polling numbers had moved 2-3 points ahead of Biden’s in the critical swing states of Michigan and Pennsylvania, dooming Biden’s chances six weeks ahead of the Democratic convention in Chicago. After the exertion of a massive pressure campaign by Nancy Pelosi and other senior Democratic leaders, Biden read the writing on the wall and ended his campaign on July 21.

With regard to Biden’s dropping out, this was a possibility that Greymantle had clearly forecast back in January of this year, wagering that the chances were around 25%. However, in all honesty, we had imagined that Biden would only drop out of the race if Haley was the GOP candidate and was polling ahead of him. That Trump would pull so far ahead of Biden that the old warhorse would be forced to cede his spot on the ticket to Kamala Harris in mid-July was a chain of events we did not foresee.

In retrospect, President Biden’s physical and mental decline should have been more obvious to us. It was obvious to a number of clear-headed observers – Ezra Klein and Ross Douthat of the NY Times notably among them – but Greymantle did not give these rumors much credence. As far as I could tell, Biden had been mumbling his words and making embarassing gaffes since the late 1980s. The president’s slurred speech I continued to attribute to the childhood stutter that he never completely overcame. It turns out that this was too benign an explanation.

TRUMP’S RESURGENCE THREATENED BY KAMALAMENTUM

And now here we are in the second week of August, with Vice President Kamala Harris as the all-but-official Democratic nominee for President and Minnesota Governor Tim Walz at her side as the Vice President presumptive. A national election has officially been ‘shaken up’.

A raft of new polling data was published on August 9 indicating that Biden’s withdrawal in favor of Harris has generated a surge of excitement among Democratic voters. Kamala Harris now leads Donald Trump in the polls by 2-3 percentage points in the same midwestern swing states referenced above where Biden had begun trailing Trump in early June. It’s a startling reversal of the political pendulum.

The rapid see-saw in the polling numbers and large crowds the Vice President has been drawing on the campaign trail, in Atlanta and Detroit most particularly, are leading the commentariat to dub the ‘vibe shift’ on the campaign trail as ‘Kamalamentum’ (i.e. the momentum generated by Kamala’s replacement of Biden at the top of the Democratic ticket). Whether Kamalamentum turns out to be a short-lived bounce of ‘voter sugar high’, versus a more durable shift in public sentiments, remains to be seen.

However, it’s clear to Greymantle, based on both the new polling data and recent news coverage of the campaigns, that the race for the White House has moved to a dead heat. Given Biden’s standing in early July compared to Harris’ now, that is the biggest shift in voter sentiments that Greymantle has seen in his lifetime. Trump may still pull ahead, particularly if Harris has a ‘bad convention’ in Chicago marred by visible Democratic Party infighting and unruly protests outside the convention center.

For now, though, we believe that the 2024 U.S. presidential race is reverting to where it was late in 2023: overall social and economic conditions favor a victory for the party in power (i.e. the Democrats). Below we reiterate the 10 major reasons why:

- Unemployment, though up to 4.3% from 3.6% fifteen months ago, remains low by historical standards. 25-year averages are around 5.1%. The labor market remains strong.

- Inflation has fallen to the 2.5% to 3% range from over 8% two years ago. The trend is moving in the right direction and Americans are beginning to notice it.

- Female voters narrowly outnumber male voters, and tend to favor the Democrats.

- Women are more likely to actually cast their votes than men.

- The Dobbs SCOTUS decision overturning Roe v. Wade in June 2022 continues to anger and energize female voters on the political left and center (and even the right, to some extent).

- Younger voters seem to be energized by Harris’s ascendancy. Ditto Black voters. These are two key Democratic constituencies that were wavering in the run-up to July 21.

- Stock market indices and home price measures have risen 40% in four years, supporting a strong ‘wealth effect’ that keeps consumer spending high and people satisfied.

- Donald Trump’s negatives in polling data remain very high, similar to Hilary Clinton’s among GOP voters and the public at large in 2016.

- Donald Trump’s campaign relies heavily on turning out ‘low propensity’ voters.

- The more they see Trump on television and online, and the more they hear him speak, the less likely voters approve of Trump. They will be hearing a lot from him in the next 3 months.

Greymantle will devote most of our postings between now and mid-November to the U.S. election, so you will be hearing more from us on all of these points as the campaigns evolve. In addition, we will be putting together short profiles on both sets of candidates for President and Vice President. Please look for those posts in August, September and October.

Finally, before we end this post, we would like to recapitulate what we got right, what we got wrong, and what hasn’t happened yet (ambiguous outcome) from among our top 20 predictions for 2024.

2024 PREDICTION OUTCOMES, YEAR-TO-DATE:

- Vladimir Putin reelected as Russian President; chance: 98%; (correct outcome)

- Russia does not initiate a full military mobilization; chance: 75%.; (correct outcome)

- The ‘border deal’ between Biden and GOP will fail to pass; chance: 95%; (correct outcome)

- Israeli PM Netanyahu will be pushed out of office; chance: 75%; (inconclusive to date)

- The Federal Reserve will cut ST rates three times in 2024; chance: 90% (inconclusive, 2 expected)

- The U.S. economy will broadly outperform forecast in 2024; chance: 85% (correct outcome)

- Far-right parties make large gains in June 2024 EU election; chance: 80%; (correct outcome)

- Labour Party wins UK election in a landslide; chance: 90%; (correct outcome)

- Haley beats Trump in series of GOP primaries; chance: 52%; (incorrect outcome – Trump won)

- Trump loses U.S. presidential election; chance: 75%; (inconclusive – election on Nov. 5)

- Biden wins U.S. presidential election; chance: 75% (incorrect outcome – Biden out of race)

- Biden will withdraw from U.S. presidential race; chance: 25% (correct outcome – Biden out of race)

- Turkish ruling AKP party performs poorly in local elections; chance: 75% (correct outcome)

- China does not invade Taiwan; chance: 80%; (inconclusive – we’ll know by Dec. 31)

- If China does make an aggressive move on Taiwan, it will be after Nov. 5 if Trump leads; chance (55%), (inconclusive – we must wait for the presidential transition period)

- China’s economy will underperform forecasts for 2024; chance: 90% (correct outcome)

- Israeli forces will neutralize the Hamas’ redoubt by late Feb. 2024; chance: 80% (incorrect)

- The Iranian regime will be overthrown, under external pressure; chance: 40%; (inconclusive)

- The Israelis will not withdraw from Gaza after six months; chance: 100%; (correct outcome)

- Venezuelan President Maduro will not step down if he loses his election; chance: 95%; (inconclusive, but it looks like he won’t, and he just stole the Venezuelan presidential election.)

Until next time, I remain —

Greymantle